Tips to Prepare for Homeownership:- With the cost of renting continuing to rise and home ownership remaining a great long-term financial investment, more people are exploring their options for buying a home.

To begin the process, you’ll need to make sure you have the savings, credit and references necessary to qualify for a mortgage loan. However, qualifying is just the start. Buying a home is an expensive proposition with many details that can easily be overlooked.

Fortunately, there are several steps you can take now to prepare yourself for homeownership and streamline the process when the time comes.

If you’re thinking about buying a house soon, or know someone who might be in the near future, read on for some great advice from real estate agents and other housing pros on how to prepare for homeownership!

Tips to Prepare for Homeownership

1) Know your credit score

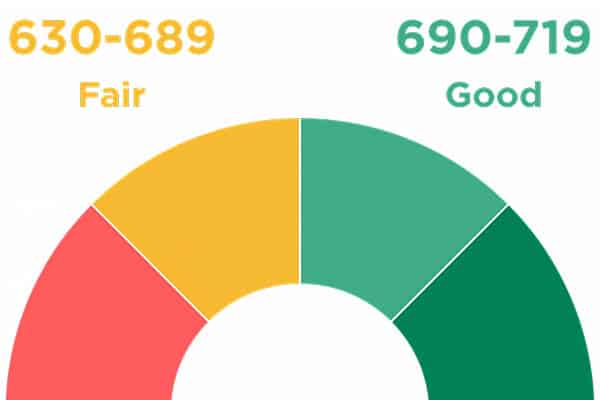

Credit scores are used by mortgage lenders to help determine if you are likely to repay your loan and what interest rate you will be offered. Higher credit scores result in lower interest rates and monthly payments,

which can save you hundreds or even thousands of dollars. Conversely, lower credit scores can result in higher interest rates and monthly payments, costing you thousands over the life of the loan.

Many people receive a free credit score each year, which can be checked at any time. If your credit score is not as high as you would like,

there are a number of ways to improve it, such as paying down high-interest debt or enrolling in a credit-building program.

2) Understand the costs

Buying a home is an investment, but it is also a huge financial commitment. You’ll need to pay closing costs, down payment and, in most cases, mortgage insurance.

Mortgage insurance is a type of coverage commonly required on low down payment loans. It protects the lender in the event that you default on your mortgage.

Closing costs are fees associated with the loan process and vary based on the type of loan you get and the lender you use. Closing costs can range from 2% to 10% of the overall loan amount.

3) Check your loan options

Before you begin your search for a house, you’ll want to select your mortgage loan type. Depending on your financial situation, income and credit history you’ll likely qualify for a few different types of loans.

Because each loan has its own requirements, selecting the right one can make a big difference in the type of house you can afford, the closing cost and the amount of time the process takes.

4) Get an inspection and estimate for repairs

A home inspection is a thorough examination of the property’s systems and major components. All federally regulated home inspections are performed by a state or federally licensed inspector.

Home inspections are not required for home sales, but many buyers choose to have one performed. Inspections typically cost between $300 and $500 and identify issues that could lead to costly repairs in the future.

5) Establish residency and lock in a rate

You’ll need to have lived in the state where you plan to buy a home for at least two years before you can apply for a mortgage.

You can expedite the process by establishing residency before you begin house hunting. One way to do this is by renting a home in the area you plan to buy.

Renting is a good option if you don’t have a job or credit history in the state. House prices are constantly rising.

If you can buy a home before interest rates rise, you may be able to get a lower rate and monthly payment. This is called locking in a rate.

Also Refer :–Approved for a Home Loan

Conclusion

Homeownership is a major financial undertaking that should not be taken lightly. However, with proper planning and preparation, you can greatly increase your chances of success.

If you’re thinking about buying a house soon, or know someone who might be in the near future,

read on for some great advice from real estate agents and other housing pros on how to prepare for homeownership!